san francisco sales tax rate 2018

To review the rules in California visit our state-by-state guide. Net absorption was negative 118930 square feet.

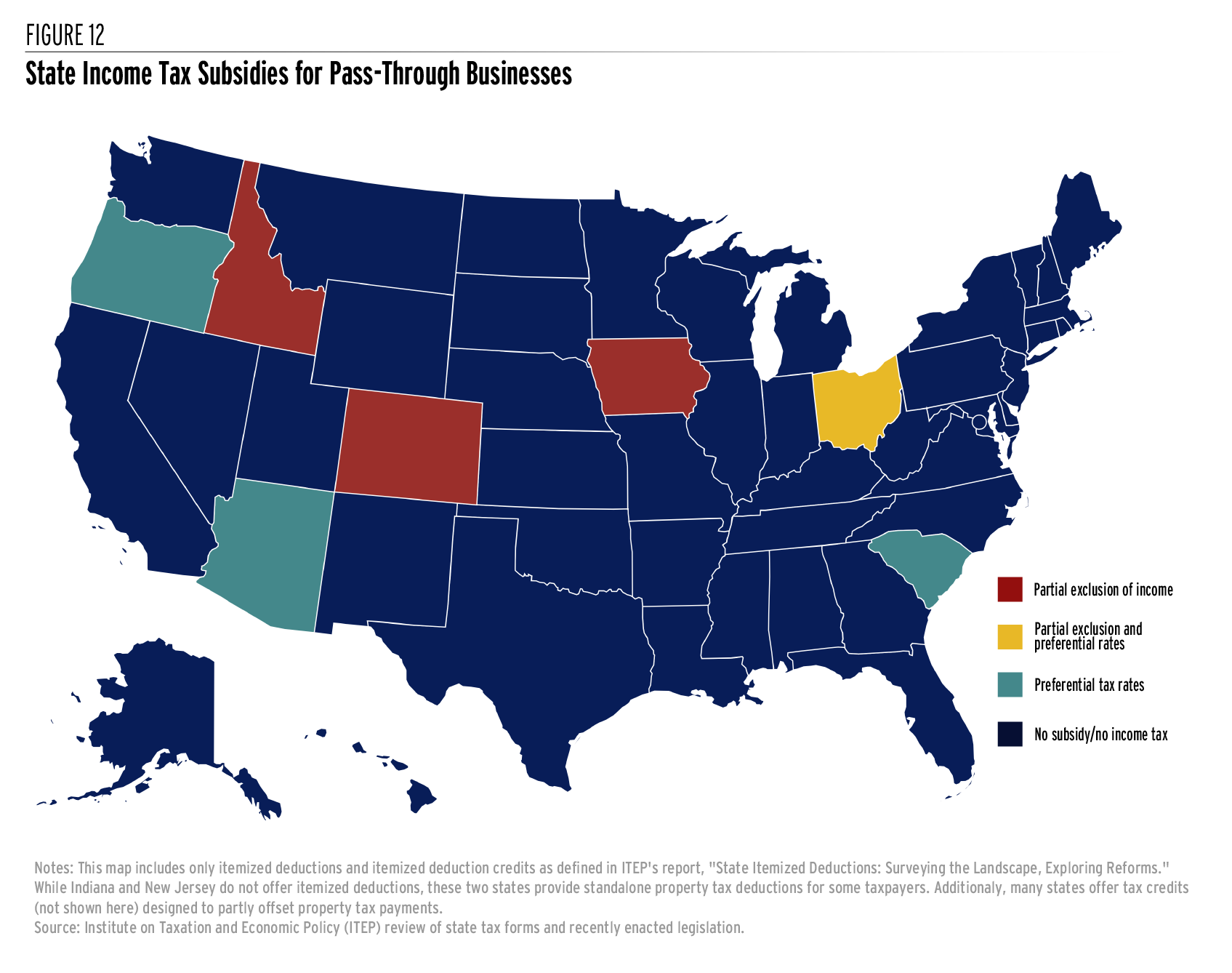

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Ad Find Out Sales Tax Rates For Free.

. The San Francisco County Sales Tax is 025 A county-wide sales tax rate of 025 is applicable to localities in San Francisco County in addition to the 6 California sales tax. The San Francisco County sales tax rate is. The County sales tax rate is.

Persons other than lessors of residential real estate ARE REQUIRED to file a Return for tax year 2018 if in 2018 you were engaged in business in San Francisco as defined in Code section 62-12 qualified by Code sections 9523. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc. Some cities and local governments in San Francisco County collect additional local sales taxes which can be as high as 3625.

The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. The 2018 United States Supreme Court decision in South Dakota v. In contrast if the business determines that another business classification applies such as professional scientific.

Finally the city also announced that the Payroll Expense Tax which was originally scheduled to phase out in 2018 will remain in place at the rate of 038 percent. Wayfair Inc affect California. There is no applicable city tax.

The 2018 Payroll Expense Tax rate is 0380 percent. The California sales tax rate is currently. County State Rate County Rate Total Sales Tax.

Back to top San Francisco tax update Download the PDF Homelessness Gross Receipts Tax. Presidio San Francisco 8625. Sales Tax Rates Updated January 2022 County.

The California state sales tax is 725 but once you tack on city and county rates it becomes 850 in San Francisco. You can read a breakdown of Californias statewide tax rate here. San Franciscos Vacancy Increases to 29 Net Absorption Negative 118930 SF in the Quarter The San Francisco retail market did not experience much change in market conditions in the second quarter 2018.

This rate is made up of 600 state sales tax rate and an additional 125 local rate. Fast Easy Tax Solutions. This 725 total sales tax rate hasnt changed for 2018.

The 2018 United States Supreme Court decision in South Dakota v. Compare this to the much more modest 32420 national average. With local taxes the total sales tax rate is between 7250 and 10750.

In addition to the existing Gross Receipts Tax the Cannabis Business Tax imposes a gross receipts tax of 1 to 5 on the gross receipts from Cannabis Business Activities attributable to the City. Presidio of Monterey Monterey 9250. The Basics of California State Sales Tax California sales tax rate.

There are many counties and cities with higher rates. For example the tax base rate for real estate rental and leasing services starts at 0285 percent and gradually increases to 03 percent. Has impacted many state nexus laws and sales tax collection requirements.

These online instructions provide a summary of the applicable rules to assist you with completing your 2018 return. The Payroll Expense Tax will not be phased out in 2018 as originally planned due to less-than-expected revenue from the Gross Receipts Tax. The Cannabis Business Tax was approved by San Francisco voters on November 6 2018 and becomes effective on January 1 2023.

The vacancy rate went from 28 in the previous quarter to 29 in the current quarter. The San Francisco sales tax rate is. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses.

The California state sales tax rate is currently. There is the regular state sales tax of 6 percent and the regular Alameda County sales tax of 325 percent. Has impacted many state nexus laws and sales tax collection requirements.

Neighboring cities tax rate bay area counties lowest city tax rate highest city tax rate average county tax rate select us cities tax rate el cerrito 975 alameda 925 975 933 chicago 1025 hayward 975 contra costa 825 975 849 new orleans 1000 san leandro 975 marin 825 900 839 seattle 1010 alameda 925 napa 775 825. California has recent rate changes Thu Jul 01 2021. For tax year 2017 the gross receipts tax rates range from 005625 to 04875.

Select the California city from the list of cities starting with S below to see its current sales tax rate. The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division. California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day of February for the prior calendar year Jan. California CA Sales Tax Rates by City S The state sales tax rate in California is 7250. Retail and wholesale Code Sec 9531 Manufacturing transportation and warehousing information biotechnology clean technology and food services Code Sec 9532 Accommodations utilities arts entertainment and recreation Code Sec 9533.

The rate for San Francisco is 85. The tax is calculated as a percentage of total payroll expense based on the tax rate for the year. San Francisco imposes a Payroll Expense Tax on the compensation earned for work and services performed within the city.

The progressive tax rate ranges between 01 to 06 and is assessed on gross receipts sourced to San Francisco as determined for Gross Receipts Tax purposes. Did South Dakota v. Taxes and Cost of Living in San Francisco.

And gross receipts are allocated based on real properties located in San Francisco. The statewide California sales tax rate is 725. You can get a list of sales tax rates for California counties and cites as of Oct 1.

Then there is a 15 percent state tax on marijuana and a 10 percent Oakland tax on. The additional tax would either increase the Gross Receipts Tax or the Administrative Office Tax whichever applies to that business and is effective January 2022. Los Angeles County has a base rate of 95 and cities there like Compton and Santa Monica have a 1025 rate.

Although this is sometimes conflated as a personal income tax rate the city only levies this tax on businesses.

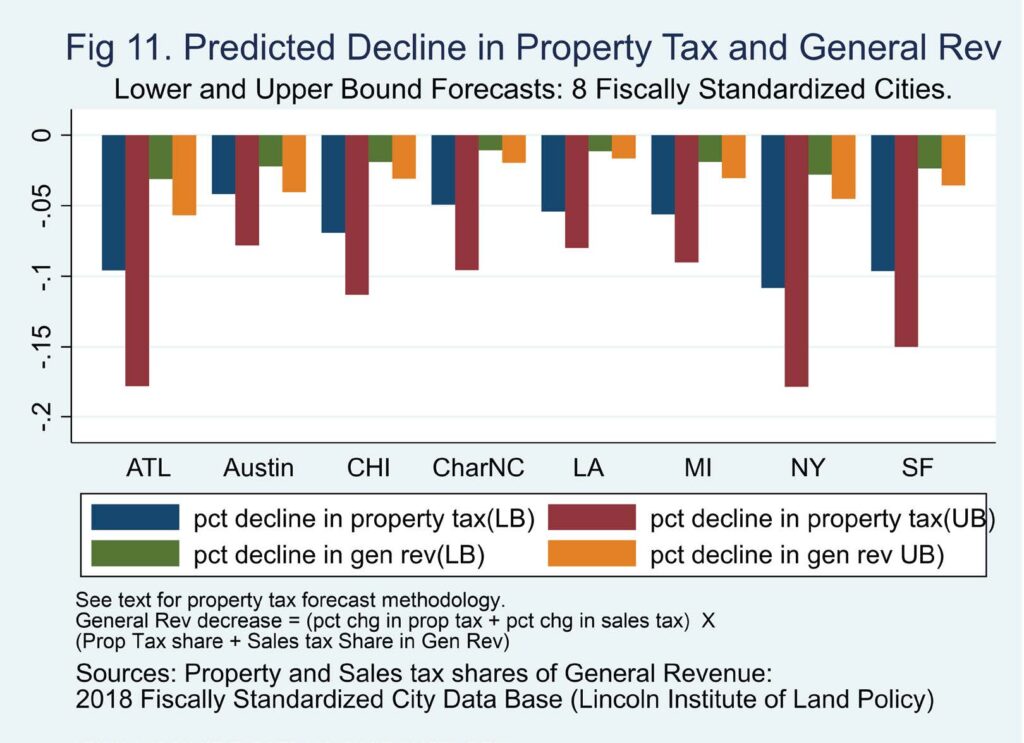

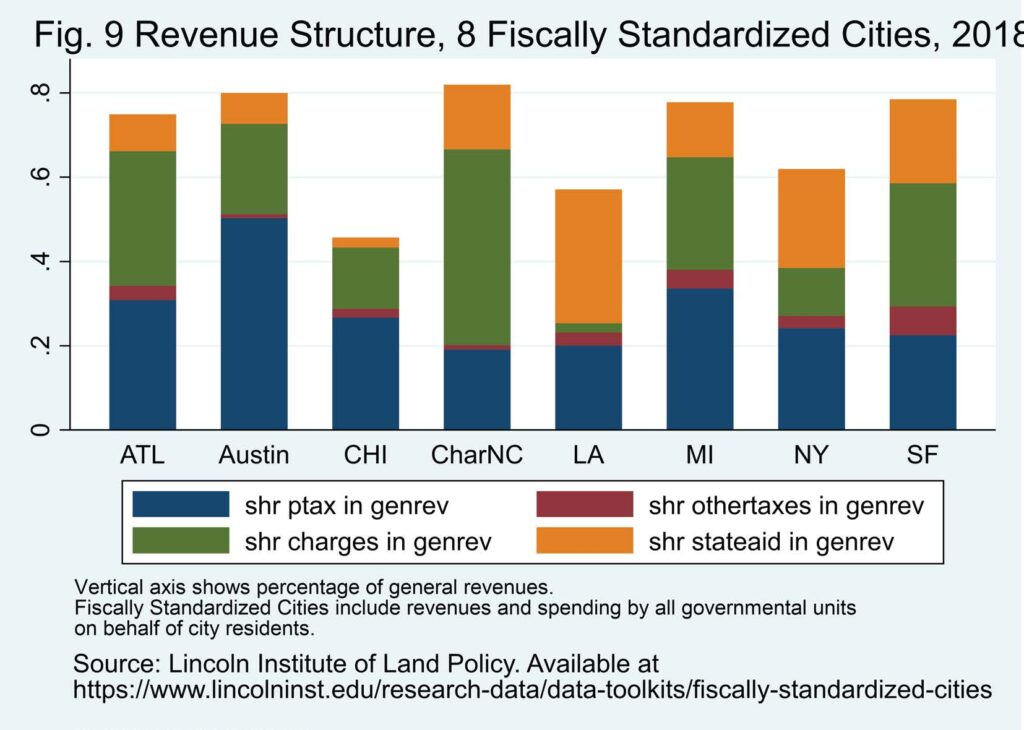

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

The Worst 5 Cities To Operate Your Business

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Amazon S Cash Flow Behind The Balance Sheet Cash Flow Balance Sheet Cash

San Francisco S Number Of Home Listings Accepting Offers Down By 22 San Francisco Business Times

Tax Rates Which County In Your State Has The Highest Tax Burden

How Do State And Local Sales Taxes Work Tax Policy Center

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Why Households Need 300 000 To Live A Middle Class Lifestyle

California State Sales Tax 2018 What You Need To Know Taxjar

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

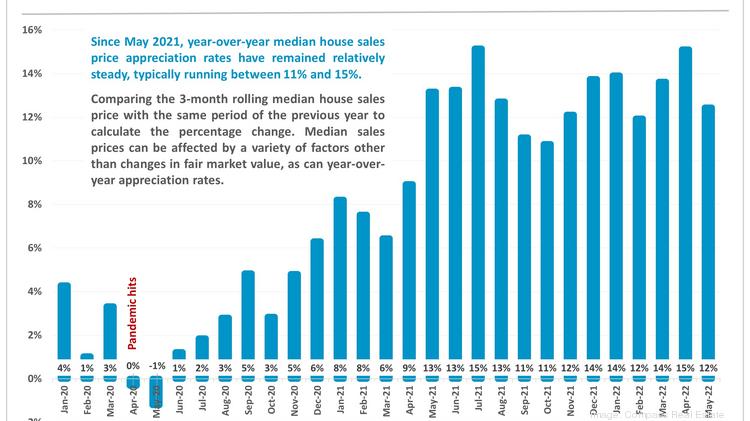

In Housing Market Gone Nuts Condo Prices Sag In San Francisco Bay Area Hover In 3 Year Range In New York Rise At Half Speed In Los Angeles Wolf Street

Why Households Need 300 000 To Live A Middle Class Lifestyle

California Sales Tax Small Business Guide Truic

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

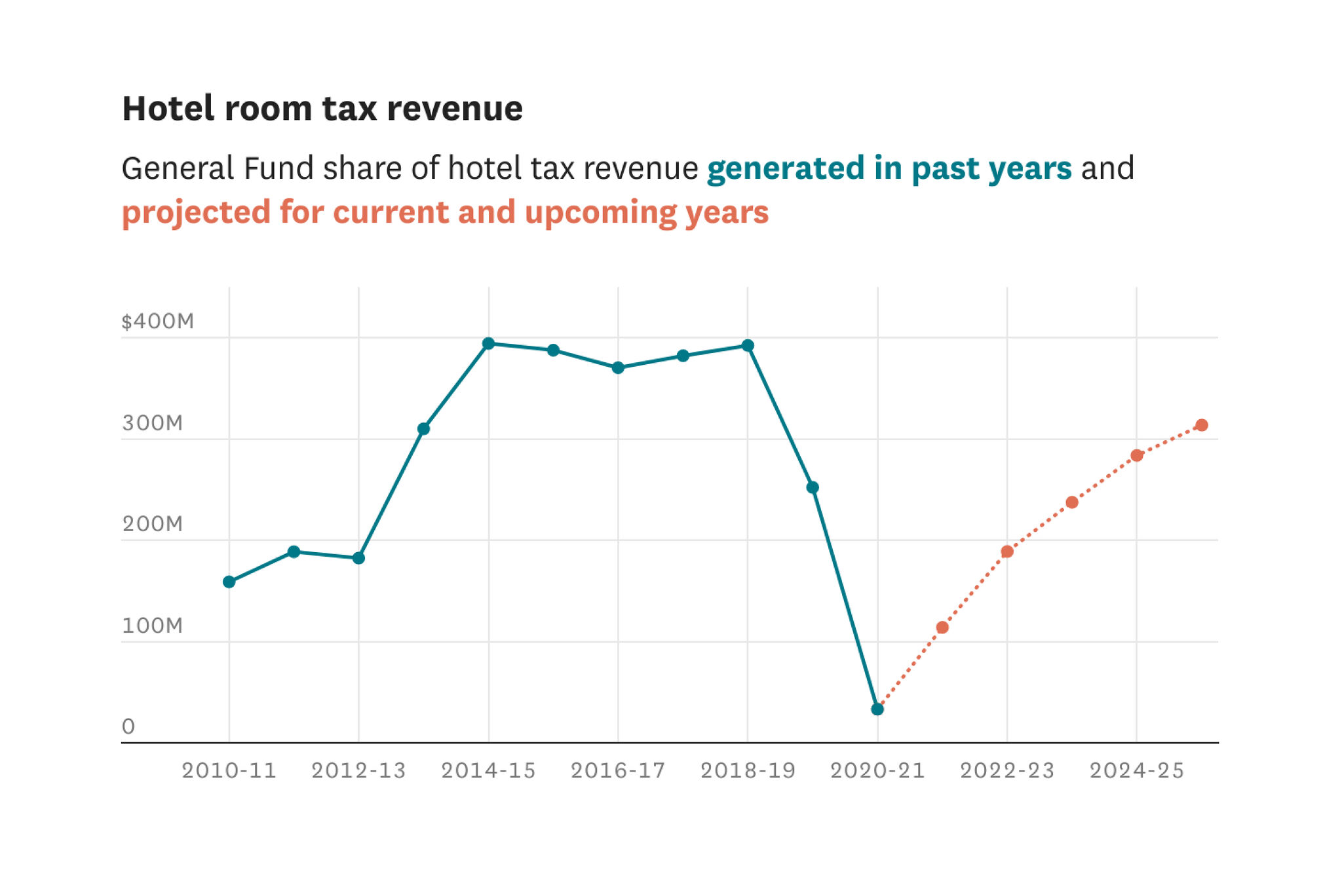

San Francisco Is Projected To Have 6 3 Billion To Spend In 2022 2023 Here S How The Pandemic Is Impacting Those Numbers